Peter Lobner, updated 8 March 2024

The term “bitcoin mining” has become a colloquial expression, but the actual activity involved in mining a crypto currency isn’t intuitively obvious to the casual observer. Marcus Lu, reporting for Visual Capitalist, can help us out here. He explained:

“When people mine bitcoins, what they’re really doing is updating the ledger of Bitcoin transactions, also known as the blockchain. This requires them to solve numerical puzzles which have a 64-digit hexadecimal solution known as a hash. Miners may be rewarded with bitcoins, but only if they arrive at the solution before others. It is for this reason that Bitcoin mining facilities—warehouses filled with computers—have been popping up around the world. These facilities enable miners to scale up their hashrate, also known as the number of hashes produced each second. A higher hashrate requires greater amounts of electricity, and in some cases can even overload local infrastructure.”

So your basic crypto currency miner needs a lot of computer processing power, electric power and an internet service provider. To get started, all of that requires some hard currency, unless you can find a work-around. Now, a few recent headlines make a bit more sense:

- “1,069 Bitcoin Miners Steamrolled In Malaysia for Stealing Energy,” 17 July 2021

- “Illegal Crypto Mining Farm With Almost 5,000 Computers Busted in Ukraine – The illegal operation cost between $186,000 and $259,300 in electricity to the state each month.” 12 July 2021

- “Police find bitcoin mine using stolen electricity in West Midlands (UK),” 28 May 2021

- “U.S. small towns take on energy-guzzling bitcoin miners,” 13 May 2021

- “Cryptocurrency miners grapple with major energy crunch in Kazakhstan,” 27 November 2021

These headlines suggest that crypto currency mining can generate significant wealth, and, for some, this prospect is worth the risk of being caught stealing a lot of electricity.

Sam Ling, writing for Miner Daily in May 2021, describes his methodology for estimating the cost to mine a bitcoin, which depends on many factors, including the cost of electricity and the cost, processing power and lifetime of the computers. Ling estimates: “It currently costs between $7,000-$11,000 USD to mine a bitcoin. …… As the price of BTC is $56,000, it remains very profitable to mine bitcoin.” You’ll find more details here: https://minerdaily.com/2021/how-much-does-it-cost-to-mine-a-bitcoin-update-may-2021/

Of course, there are many legitimate businesses mining bitcoins. You’ll find a list of the top bitcoin mining firms here: https://www.ventureradar.com/keyword/Bitcoin%20Mining

At the industrial-size end of the crypto mining facility spectrum, US power company Talen Energy announced in July 2021 that it is planning to develop a nuclear-powered crypto mining facility and data center adjacent to its two unit, 2,494 MWe Susquehanna Steam Electric Station in Pennsylvania. The first phase of the crypto mining facility will require 164 MW of power and is due to come online in Q2 2022. When complete, the crypto mining facility will require 300 MW of on-site power supplied from the nuclear power plants via two independent substations. The potential exists to expand the crypto mining facility to 1,000 MW capacity in the future.

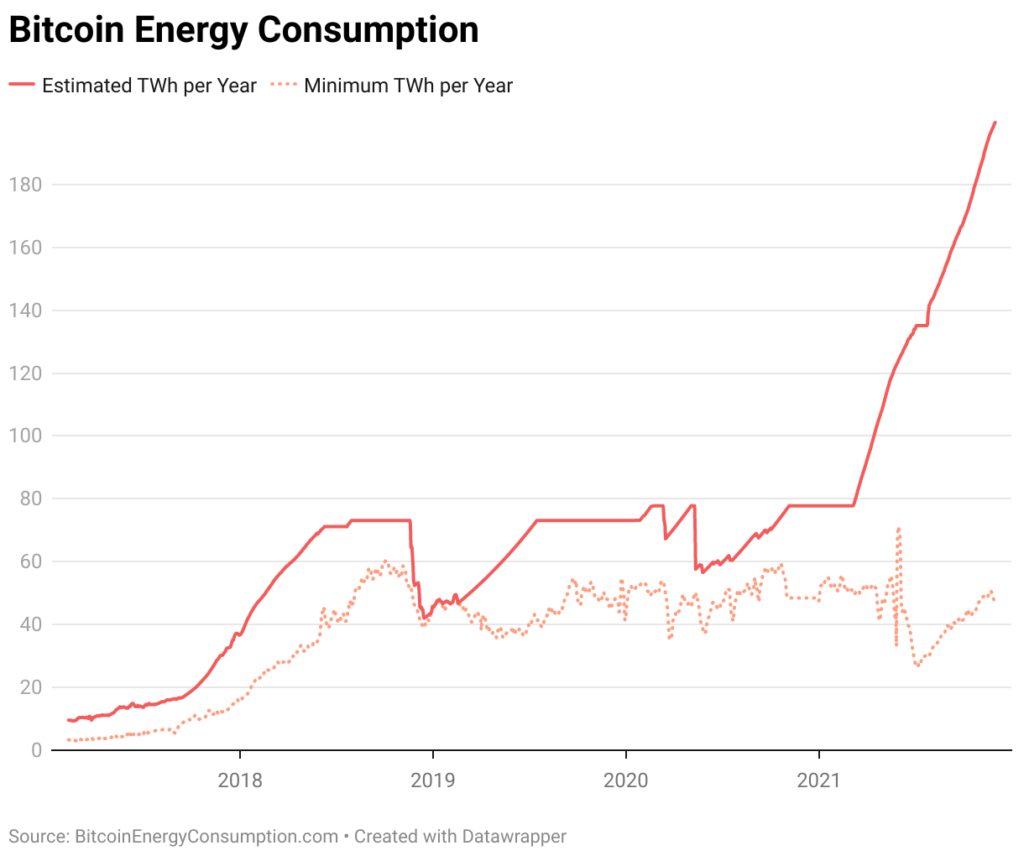

In May 2021, Nic Carter reported in the Harvard Business Review, “According to the Cambridge Center for Alternative Finance (CCAF), Bitcoin currently consumes around 110 Terawatt-Hours per year — 0.55% of global electricity production, or roughly equivalent to the annual energy draw of small countries like Malaysia or Sweden.” That would put current global crypto currency mining energy consumption at about 30th place among all nations in the world. In the future, energy consumption for crypto currency mining is certain to increase, perhaps dramatically. Is there an upper limit?

The current trend in tracked by Digiconomist with their Bitcoin Energy Consumption Index, which provides the latest estimate of the total energy consumption of the Bitcoin network. The following chart is from their website here: https://digiconomist.net/bitcoin-energy-consumption/

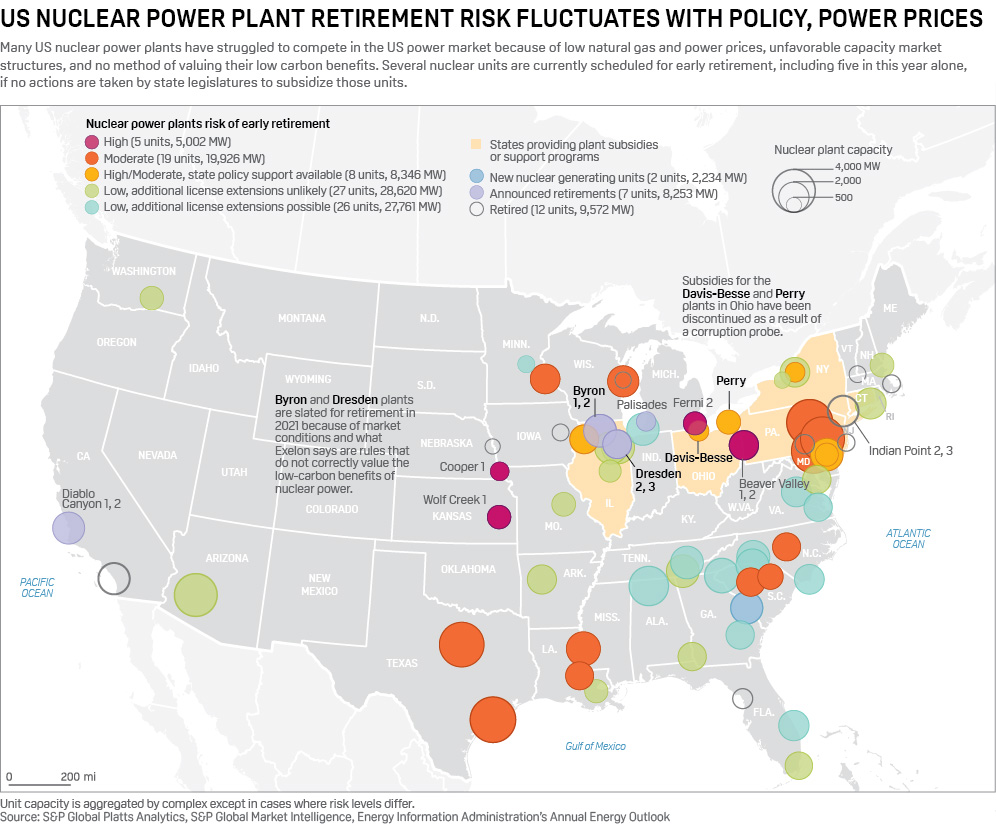

While the Susquehanna Steam Electric Station is fortunate to have a gained a new customer for their electric power, Exelon Generation reported in June 2021 that three of its Illinois nuclear power plants, Byron, Dresden, and Quad Cities, did not clear the PJM Interconnection capacity auction. This means that these Exelon nuclear plants have lost a customer for their future electric power generation. The issue is complex, but appears to be rooted in power auction rules that are, at least in part, inconsistent with the nation’s goal of reducing the overall carbon footprint of electric power generation. Exelon explained:

“Byron and Dresden, despite being efficient and reliable units, face revenue shortfalls in the hundreds of millions of dollars because of declining energy prices and market rules that allow fossil fuel plants to underbid clean resources in the PJM Interconnection capacity auction.”

In mid-September 2021, Illinois Gov. J.B. Pritzker signed an energy bill (Senate Bill 2408) that included provisions for Exelon to receive the financial incentives it needed to keep the Byron and Dresden nuclear plants open. Exelon subsequently confirmed that the plants will continue operating for at least six more years (thru 2027).

Exelon is not the only US nuclear power utility with this type of issue. Several more US nuclear power plants are at risk of retiring prematurely instead of seeking a license extension to operate for another 20 years generating zero-carbon electricity. S&P Global Platts provides a good overview of the seriousness of the current situation in the following infographic:

Congress and the state governments need to act now to protect the nuclear power plants at high risk of premature closure, and ensure their continued operation as generators of zero-carbon electricity.

Perhaps the planned Talen Energy crypto currency mining venture points to an odd synergism between miners and nuclear power plant operators. Instead of retiring nuclear power plants that are struggling financially, it may make sense to the owners to build crypto mining facilities and reap the profits from crypto currency sales. Taken to its extreme, you can imagine a nuclear power plant diverting all of its zero-carbon electric power output to its own very profitable crypto mining facility. Just imagine how many Bitcoins could be generated by diverting all US nuclear power plant electricity generation (about 20% of total US electricity generation) to power crypto currency miners.

Going back to my question “Is there an upper limit?,” I’m afraid only time will tell.

8 March 2024 update: Talen Energy data center sold

The completed Talen Energy data center building at the Susquehanna nuclear plant. Source: Talen Energy

Talen Energy’s bitcoin mining adventure was not successful. In May 2022, the firm filed for Chapter 11 bankruptcy in connection with a financial restructuring of the firm. After exiting bankruptcy in 2023, the firm sought to sell its Susquehanna data center as a means to pay off debts and generally improve its cash flow. On 4 March 2024, Talen Energy announced the sale of its Susquehanna data center campus for $650 million to cloud service provider Amazon Web Services (AWS). By virtue of its existing Power Purchase Agreement (PPA) with Susquehanna, Talen Energy remains as an energy retailer, positioned between the Susquehanna nuclear power plant and the AWS-owned data center. Talen will providing fixed-price electricity to the AWS data center, which has a contractual commitment to ramp up its power demand as the data center is expanded over several years. AWS has a one-time option to cap its power demand at 480 MW. Talen will be able to supply up to 960 MW of power under the terms of its PPA with Susquehanna.

For more information

- Marcus Lu, “Visualizing the Power Consumption of Bitcoin Mining,” Visual Capitalist, 20 April 2021: https://www.visualcapitalist.com/visualizing-the-power-consumption-of-bitcoin-mining/

- Sam Ling, “How Much Does it Cost to Mine a Bitcoin? Update May 2021,” Miner Daily, 4 May 2021: https://minerdaily.com/2021/how-much-does-it-cost-to-mine-a-bitcoin-update-may-2021/

- Euny Hong, “How Does Bitcoin Mining Work?,” Investopia, 4 May 2021:https://www.investopedia.com/tech/how-does-bitcoin-mining-work/

- Nic Carter, “How Much Energy Does Bitcoin Actually Consume?,” Harvard Business Review, 5 May 2021: https://hbr.org/2021/05/how-much-energy-does-bitcoin-actually-consume

- Lisa Iscrupe, “Bitcoin mining energy consumption,” Choose Energy, 18 May 2021: https://www.chooseenergy.com/news/article/bitcoin-mining-energy-consumption/

- Dan Swinhoe, “Talen Energy to build 300MW nuclear-powered cryptomining facility and data center in US,” DataCenterDynamics, 12 July 2021: https://www.datacenterdynamics.com/en/news/talen-energy-to-build-300mw-nuclear-powered-cryptomining-facility-and-data-center-in-us/

- Brad Bergen, “Crypto Miners Are Buying Entire Power Plants to Feed Their Energy Needs,” Interesting Engineering, 15 July 2021: https://interestingengineering.com/crypto-miners-buying-power-plants

- Florent Heidet, “Why Crypto Mining Needs Nuclear Power, CoinDesk, 13 October 2021: https://www.coindesk.com/policy/2021/10/13/why-crypto-mining-needs-nuclear-power/

- “AWS acquires data center campus connected to Susquehanna nuclear station,” Power Engineering, 5 March 2024: https://www.power-eng.com/nuclear/aws-acquires-data-center-campus-connected-to-susquehanna-nuclear-station/#gref

- “Amazon buys nuclear-powered data center from Talen,” Nuclear Newswire, 7 March 2024: https://www.ans.org/news/article-5842/amazon-buys-nuclearpowered-data-center-from-talen/

Nuclear power plants at risk of closure

- “Byron, Dresden, Quad Cities fail to clear in PJM capacity auction,” American Nuclear Society, 8 June 2021: https://www.ans.org/news/article-2967/byron-dresden-quad-cities-fail-to-clear-in-pjm-capacity-auction/

- “Exelon to close Byron and Dresden plants in 2021,” American Nuclear Society, 27 August 2020: https://www.ans.org/news/article-475/exelon-to-close-byron-and-dresden-plants-in-2021/

- Jared Anderson & William Freebairn, “FEATURE: US nuclear power plant retirement risk fluctuates with policy, power prices,” S&P Global Platts, 3 May 2021: https://www.spglobal.com/platts/en/market-insights/latest-news/electric-power/050321-feature-us-nuclear-power-plant-retirement-risk-fluctuates-with-policy-power-prices

- Shaquil Manigault, “’It was relief’: Exelon pledges jobs, multimillion-dollar upgrades at Illinois plants,” Rockford Register Star, 4 October 2021: https://www.rrstar.com/story/news/2021/10/04/exelon-pledges-650-jobs-improvements-in-byron-dresden/5947516001/

Bitcoin miner energy theft & adverse impacts on electrical grids

- Loukia Papadopoulos, “1,069 Bitcoin Miners Steamrolled In Malaysia for Stealing Energy,” Interesting Engineering, 17 July 2021: https://interestingengineering.com/1069-bitcoin-miners-steamrolled-in-malaysia-for-stealing-energy

- Kevin Shalvey, “Take a look inside this underground crypto mining farm in Ukraine with its 3,800 PlayStations and 5,000 computers,” Business Insider, 11 July 2021: https://www.businessinsider.com/take-a-look-inside-an-underground-crypto-farm-busted-by-ukraine-police-2021-7

- Jasper Jolly, “Police find bitcoin mine using stolen electricity in West Midlands,” The Guardian, 28 May 2021: https://www.theguardian.com/technology/2021/may/28/police-find-bitcoin-mine-using-stolen-electricity-west-midlands

- Eliza Gkritsi, “Kazakhstan’s Crypto Miners Face New Regulations After Contributing to Power Shortages,” CoinDesk, 12 November 2021: https://www.coindesk.com/policy/2021/11/12/kazakhstans-crypto-miners-face-new-regulations-after-contributing-to-power-shortages/

- Emma Roth, “Cryptocurrency miners grapple with major energy crunch in Kazakhstan – An influx of Chinese miners have contributed to the power shortages,” The Verge, 27 November 2021: https://www.theverge.com/2021/11/27/22805033/kazakhstan-cryptocurrency-miners-suffer-energy-shortages