Peter Lobner

The U.S. Geologic Survey produces a series of mineral commodity annual reports and individual commodity data sheets. The web page for the index to these reports and data sheets is at the following link:

http://minerals.usgs.gov/minerals/pubs/mcs/

One particularly interesting document, with a very dull sounding title, is, Mineral Commodity Summaries 2015, which you can download for free at the following link:

http://minerals.usgs.gov/minerals/pubs/mcs/2015/mcs2015.pdf

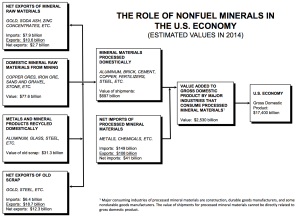

This USGS report starts by putting the non-fuel mineral business sector in context with the greater U.S. economy. In the USGS chart below, you can see that the non-fuel mineral business sector makes up 13.5% of the U.S. economy. By dollar volume, net imports of processed mineral materials make up only a small portion (about 1.6%) of the non-fuel mineral business.

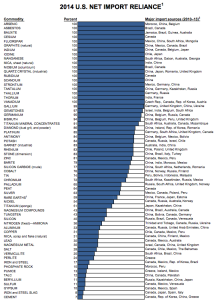

In the, Mineral Commodity Summaries 2015, USGS also identified the U.S. reliance on non-fuel minerals imports. Their chart for 2014 is reproduced below.

Many of the above non-fuel minerals have very important uses in high-value products created in other business sectors. A good summary table on this matter appears in the National Academies Press report entitled, Emerging Workforce Trends in the U.S. Energy and Mining Industries: A Call to Action, published in August 2015. You can view or download this report for free at the following link:

In this report, refer to Table 2.5, Common or Essential Products and Some of Their Mineral Components.

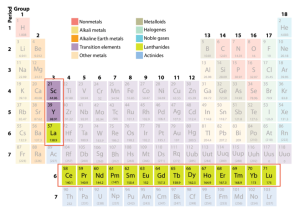

Among the minerals with very important roles in modern electrical and electronic components and advanced metals is the family of rare earths, which is comprised of the 17 elements highlighted in the periodic table, below:

- the 15 members of the Lanthanide series from 57La (Lanthanum) to 71Lu (Lutetium), and

- the two Transitional elements 21Sc (Scandium) and 39Y (Yttrium).

Source: www.rareelementresources.com/

In the above 2014 import reliance chart, USGS reported that the U.S. continued to be a net importer of rare earth minerals (overall, 59% reliant), and that for Scandium the U.S was 100% reliant on imports.

In the Mineral Commodity Summaries 2015, USGS reported the following usage of rare earth minerals in the U.S.:

- General uses: catalysts, 60%; metallurgical applications and alloys, 10%; permanent magnets, 10%; glass polishing, 10%; and other, 10%.

- Scandium principal uses: solid oxide fuel cells (SOFCs) and aluminum-scandium alloys. Other uses are in ceramics, electronics, lasers, lighting, and radioactive isotopes used as a tracing agent in oil refining

China became the world’s dominant producer of rare earths in the 1990s, replacing U.S. domestic producers, none of which could not compete economically with the lower prices offered by the Chinese producers.

On March 22, 2015, the CBS TV show 60 Minutes featured a segment on the importance of rare earth elements and underscored the need to ensure a domestic supply chain of these critical minerals. You can view this segment at the following link:

https://www.youtube.com/watch?v=N1HiX0HiAuo

In December 2011, the U.S. Department of Energy (DOE) issued a report entitled Critical Materials Strategy, which you can download for free at the following link:

http://energy.gov/sites/prod/files/DOE_CMS2011_FINAL_Full.pdf

The summary results of the DOE “criticality assessment” are reproduced below

“Sixteen elements were assessed for criticality in wind turbines, EVs (electric vehicles), PV (photovoltaic) cells and fluorescent lighting. The methodology used was adapted from one developed by the National Academy of Sciences. The criticality assessment was framed in two dimensions: importance to clean energy and supply risk. Five rare earth elements (REEs)—dysprosium, terbium, europium, neodymium and yttrium—were found to be critical in the short term (present–2015). These five REEs are used in magnets for wind turbines and electric vehicles or phosphors in energy-efficient lighting. Other elements—cerium, indium, lanthanum and tellurium—were found to be near-critical. Between the short term and the medium term (2015– 2025), the importance to clean energy and supply risk shift for some materials (Figures ES-1 and ES-2).”

While the results of the DOE criticality assessment focused on importance to the energy sector, the identified mineral shortages will impact all business sectors that depend on these minerals, including consumer electronics and national defense.

Further insight on the importance of rare earths is provided by an annual report to the Senate Select Committee on Intelligence entitled, U.S. Intelligence Community Worldwide Threat Assessment Statement for the Record. The report delivered on March 12, 2013 highlighted the national security threat presented by China’s monopoly on rare earth elements. You can download that report at the following link:

https://www.hsdl.org/?view&did=732599

The 2013 threat assessment offered the following perspective on the strategic importance of rare earth minerals:

“Rare earth elements (REE) are essential to civilian and military technologies and to the 21st century global economy, including development of green technologies and advanced defense systems. China holds a commanding monopoly over world REE supplies, controlling about 95 percent of mined production and refining. China’s dominance and policies on pricing and exports are leading other countries to pursue mitigation strategies, but those strategies probably will have only limited impact within the next five years and will almost certainly not end Chinese REE dominance.”

While the above focus has been on rare earths, the discussion serves to illustrate that the U.S. is dependent on importing many minerals that are very important to the national economy.