Peter Lobner, updated 15 March 2024

1. Introduction

On a 2016 road trip to the Black Hills, I had long transit days each way on Interstate 90 through southern Minnesota and South Dakota. One thing I noticed was that many of the heavy tractor-trailers on this high speed route were modern, streamlined vehicles that used a variety of aerodynamic devices that appeared useful for reducing aerodynamic drag and fuel consumption.

These tractor-trailers are Class 8 heavy trucks with a gross vehicle weight (GVW) of greater than 33,000 pounds (14,969 kg). The maximum GVW is set on a case-by-case basis using the Federal Bridge Formula Weights published by the Department of Transportation’s (DOT) Federal Highway Administration (FHWA) at the following link: https://ops.fhwa.dot.gov/freight/publications/brdg_frm_wghts/index.htm

For example, a long 5-axle tractor-trailer, commonly called an “18-wheeler,” can have a GVW up to 85,500 pounds (38,782 kg), but it is limited to a maximum GVW of 80,000 pounds (36,287 kg) when operating on federal interstate highways. The higher weight limit may apply on other roads if permitted by state and local jurisdictions.

Class 8 Trucks make up only 4% of the vehicles on the road. However, they use about 20% of the nation’s transportation fuel. The following Department of Energy (DOE) video, entitled “Energy 101: Heavy Duty Vehicle Efficiency,” provides an introduction to what’s being done to introduce a variety of new technologies that will improve the performance and economy of Class 8 tractor-trailers while reducing their environmental impact: https://www.energy.gov/eere/videos/energy-101-heavy-duty-vehicle-efficiency

In this post, we’ll take a look at the following:

- Three US and Canadian programs to improve tractor-trailer aerodynamics, fuel efficiency and freight efficiency:

- US Environmental Protection Agency (EPA) SmartWay® Transport Partnership

- Canadian Center for Surface Transportation Technology

- US Department of Energy (DOE) SuperTruck program

- The North American Council for Freight Efficiency’s (NACFE) Annual Fleet Fuel Study for 2019, which provides insights into the current state of the US Class 8 tractor-trailer fleet.

- Accessories available to improve the aerodynamic efficiency of existing Class 8 tractor-trailers.

- Aerodynamic Class 8 tractor-trailers from major US manufacturers, including:

- Manufacturer’s flagship Class 8 trucks

- Test trucks developed for the DOE SuperTruck program

- Other advanced Class 8 truck designs and test trucks that are demonstrating new freight vehicle technologies.

- Electric-powered Class 8 trucks that are about to enter service with the potential to revolutionize the freight trucking industry.

You can download this post as a pdf file here: https://lynceans.org/wp-content/uploads/2020/04/SuperTrucks-–-Revolutionizing-the-Heavy-Tractor-Trailer-Freight-Industry-with-Science.pdf.

In the body of this post are links to 12 individual articles I’ve written on advanced Class 8 trucks, each of which can be downloaded as a pdf file. You’ll also find many other links to useful external resources.

2. US and Canadian programs to improve tractor-trailer aerodynamics and freight efficiency

Freight transportation is a cornerstone of the U.S. economy. In 2012, U.S. businesses spent $1 trillion to move $12 trillion worth of goods (8.5% of GDP). However, freight accounts for 9% of all U.S. greenhouse gas (GHG) emissions, and trucking is the dominant mode. The following programs are focused on reducing the GHG emissions of the freight trucking industry.

2.1 US SmartWay® Transport Partnership

The trucking industry’s ongoing efforts to improve heavy freight vehicle performance and economics were aided in 2004 by the creation of the SmartWay® Transport Partnership, which is administered by the Environmental Protection Agency (EPA). SmartWay® is a voluntarily program for achieving improved fuel efficiency and reducing the environmental impacts from freight transport. The goal is, “to move more freight, more miles, with lower emissions and less energy.” The SmartWay® website is at the following link: https://www.epa.gov/smartway

SmartWay® is promoting the following strategies to help the heavy trucking industry meet this goal:

- Idle reduction

- Speed control

- Driver training

- Aerodynamics

- Tire technologies

- Lubricants

- Hybrid power trains

- Improved freight logistics

- Vehicle weight reduction

- Intermodal freight capability

- Alternative fuels

- Long combination vehicles (LVCs, such as double trailers)

A truck and trailer fitted out with all the essential efficiency features can be sold as a SmartWay® “designated” model. A “designated” tractor-trailer combo can be as much as 20% more fuel-efficient than the comparable standard model.

2.2 Canadian Center for Surface Transportation Technology

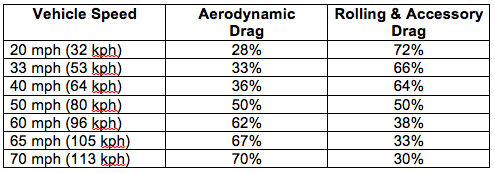

In May 2012, the Canadian Center for Surface Transportation Technology (CSTT) issued technical report CSTT-HVC-TR-205, entitled, “Review of Aerodynamic Drag Reduction Devices for Heavy Trucks and Buses.” In Table 2 of this report, CSTT provides the following table showing the relative power consumption of aerodynamic drag and rolling / accessory drag as a function of vehicle speed for a representative heavy truck on a zero grade road with properly inflated tires. Results will be different for streamlined trucks that have already have taken steps to reduce aero drag.

In this example, rolling / accessory drag dominates at lower speeds typical of urban driving. At 50 mph (80 kph) aerodynamic drag and rolling / accessory drag are approximately equal. At higher speeds, aerodynamic drag dominates power consumption. The speed limit on I-90 in South Dakota typically is 80 mph (129 kph). At this speed the aero drag contribution is even higher than shown in the above table.

Key points from this CSTT report include the following:

- For tractor-trailers, pressure drag is the dominant component of vehicle drag, due primarily to the large surface area facing the main flow direction and the large, low-pressure wake resulting from the bluntness of the back end of the vehicle.

- Aero-tractor models can reduce pressure drag by about 30% over the boxy classic style tractor.

- Friction drag occurring along the sides and top of tractor-trailers makes only a small contribution to total drag (10% or less), so these areas are not strong candidates for drag-reduction.

- The gap between the tractor and the trailer has a significant effect on total drag, particularly if the gap is large. Eliminating the gap entirely could reduce total drag by about 7%.

- Side skirts or underbody boxes prevent airflow from entering the under-trailer region. These types of aero devices could reduce drag by 10 – 15%.

- Wind-tunnel and road tests have demonstrated that a “boat tail” with a length of 24 – 32 inches (61 – 81 cm) is optimal for reducing drag due to the turbulent low-pressure region behind the trailer.

- Adding a second trailer to form a long combination vehicle (LCV), and thus doubling the freight volumetric capacity, results in a very modest increase in drag coefficient (as low as about 10%) when compared to a single trailer vehicle.

- In cold Canadian climates, the aerodynamic drag in winter can be nearly 20% greater than at standard conditions, due to the ambient air density. For highway tractor-trailers, this results in about a 10% increase in fuel consumption from aerodynamic drag when compared to the reference temperature, further emphasizing the importance of aerodynamic drag reduction strategies for the Canadian climate.

You can read an executive summary of this CSTT report at the following link: https://www.tc.gc.ca/en/programs-policies/programs/ecotechnology-vehicles-program/etv-technical-papers/review-aerodynamic-drag-reduction-devices-heavy-trucks-buses.html

2.3 Department of Energy (DOE) SuperTruck Program

SuperTruck is major DOE technology innovation program with many industry partners representing a broad segment of the US industrial base for heavy tractor-trailers. This program, run by DOE’s Vehicle Technologies Office, focused on Class 8 trucks with internal combustion engines during the first two five-year program phases known as SuperTruck 1 and 2. Program focus shifted to electric powertrains in the third five-year phase known as SuperTruck 3.

Following is an overview of the SuperTruck program. Additional sources of information are listed at the end of this post.

SuperTruck 1 (2010-2016)

The first phase, known as SuperTruck 1, was a $284 million public-private partnership in which industry matched federal grants dollar-for-dollar. Four Class 8 truck manufacturers led teams in the SuperTruck 1 program:

- Freightliner (Daimler North America)

- International (Navistar)

- Peterbilt (teamed with Cummins)

- Volvo North America

Objectives for the DOE SuperTruck 1 program were:

- Demonstrate a 50% freight efficiency improvement from a “baseline” 2009 model year Class 8 tractor-trailer.

- Freight efficiency is the product of payload weight (in tons) and fuel economy (in miles per gallon), with results reported in North America as ton-miles per gallon.

- Performance would be measured with a demonstration SuperTruck operated at 65,000 pounds GVW.

- Average fuel efficiency of the baseline tractors in SuperTruck 1 was 6.2 mpg.

- Improve engine efficiency by 8% to achieve 50% brake thermal efficiency (BTE), and thereby boost fuel efficiency by 16%.

- The BTE of an engine is the ratio of Brake Power (BP) to Fuel Power (FP).

- Brake power (BP) is the amount of power available at the crankshaft, taking into account engine friction losses (i.e., between cylinder and walls, crankshaft bearing, etc.).

- Fuel power (FP) is a measure of the calorific value of the fuel used to deliver a particular value of BP.

- Typical Class 8 truck diesel engines operate at 41 – 43% BTE. This means that 41 – 43% of the calorific value of the fuel is converted into power available at the crankshaft. The remaining 57 – 59% of the calorific value of the fuel is lost as heat that is carried off by the engine cooling system and engine exhaust system. In some advanced engines, turbochargers and waste heat recovery systems are used to increase BTE by recovering some energy from exhaust gases.

- Show pathways for a further 5% improvement in engine efficiency (to achieve a BTE of 55%).

The four SuperTrucks developed by the respective teams are described in Section 5. All teams met or exceeded the SuperTruck I objectives set by DOE.

SuperTruck 2 (2017 – 2022)

SuperTruck 2 is a five-year, $160-million public-private partnership with industry matching federal grants dollar-for-dollar. Five teams are participating in the SuperTruck 2 program:

- In August 2016, DOE announced that the four teams from SuperTruck 1 would continue their participation in SuperTruck 2.

- A new team led by PACCAR, with truck manufacturer Kenworth as a team member, joined SuperTruck 2 in October 2017.

Objectives for the DOE SuperTruck 2 program are:

- Improve freight efficiency (ton-miles per gallon) by 100% relative to a “best in class” 2009 truck (same baseline as in SuperTruck I), with a stretch goal of 120%.

- Demonstrate 55% Brake Thermal Efficiency on an engine dynamometer.

- Develop technologies that are commercially cost effective in terms of a simple payback.

Michael Berube, head of DOE’s Vehicle Technologies Office, acknowledged that the SuperTruck 2 objectives are beyond what the participants think they can achieve. However, with industry receiving dollar-for-dollar federal grants, Berube said, “…the program will allow them to try higher-risk technologies than they might on their own.”

Among the candidate technologies for SuperTruck 2 are:

- Engines with waste heat recovery

- Various forms of hybrid diesel-electric systems

- More radical aerodynamic improvements, including active devices and completely redesigned cabs.

“Think of the benefit to the industry and to the country if they can meet that goal of doubling freight efficiency. There are 1.7 (to 2.5) million Class 8 trucks out there, each traveling an average of 66,000 miles a year. Doubling their efficiency could reduce petroleum consumption by 300 million barrels a year,” Berube said. At today’s fuel costs, that would save operators up to $20,000 per truck per year.

While most SuperTruck 2 programs wrapped up in 2022, PACCAR’s program was completed at the end of 2023 due to its later starting date.

SuperTruck 3 (2022 – 2027)

In October 2021, DOE launched a $199 million, five-year program to support the development of zero-emission vehicles, with $127 million directed to the SuperTruck 3 program, which will fund 50:50 cost-sharing projects to develop battery-electric and fuel cell medium- and heavy-duty trucks and freight system solutions with payload capacity and range equivalent to typical diesel-powered counterpart vehicles.

This DOE program includes three firms from the previous SuperTruck 2 program: PACCAR Inc., Volvo Group North America and Daimler Trucks North America.

- PACCAR Inc.: $33 million in DOE cost-sharing funds to develop 18 Class 8 battery-electric vehicles with advanced batteries and a demonstration megawatt-class charging station.

- Volvo Group North America: $18 million in DOE cost-sharing funds to develop a 400-mile-range Class 8 battery-electric tractor-trailer with advanced aerodynamics, electric braking, EV-optimized tires, automation and route planning. It also will develop and demonstrate a megawatt-class charging station.

- Daimler Trucks North America: $26 million in DOE cost-sharing funds to develop and demonstrate two Class 8 hydrogen fuel cell trucks with a 600-mile range and 25,000-hour durability.

In addition, the SuperTruck 3 program includes Ford Motor Company and General Motors, both of which will focus on smaller freight vehicles, up to Class 6 Super Duty trucks.

3. The NACFE Annual Fleet Fuel Study

The North American Council for Freight Efficiency (NACFE) (https://nacfe.org/) describes its mission as working to “drive the development and adoption of efficiency enhancing, environmentally beneficial, and cost-effective technologies, services and methodologies in the North American freight industry.”

One of NACFE’s important products is the Annual Fleet Fuel Study, which reports on the adoption of 85 technologies and practices for improving freight efficiency among major North American Class 8 truck fleets operators. The 2019 Annual Fleet Fuel Study was based on data from 21 fleets operating 73,844 tractors and 239,292 trailers. You can download the NACFE 2019 Annual Fleet Fuel Survey here: https://nacfe.org/annual-fleet-fuel-studies/

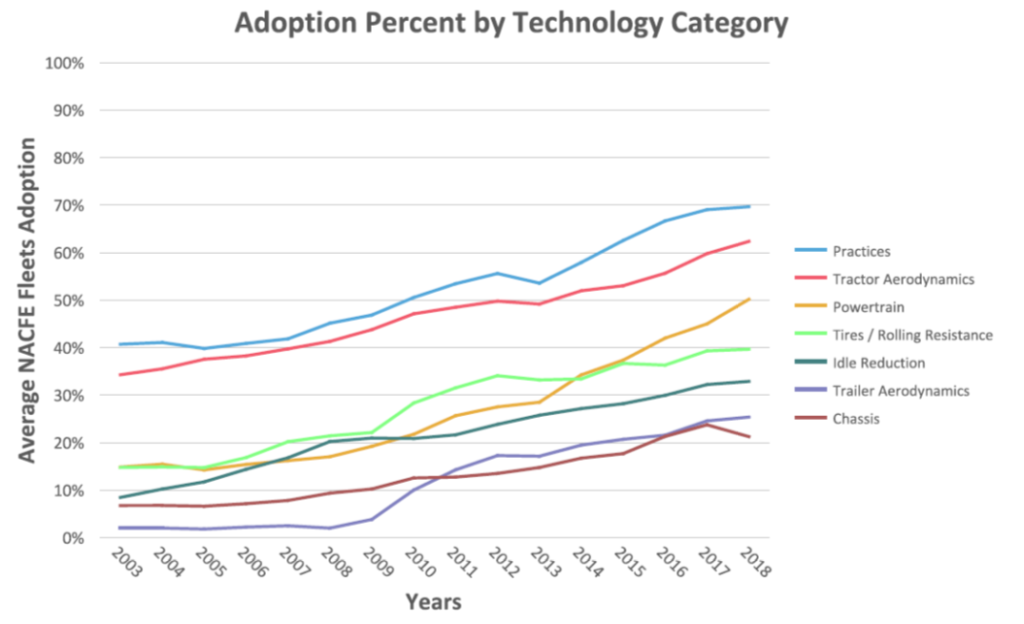

The following chart shows adoption rates among NACFE member fleets in seven technology categories. Tractor aerodynamic improvements (light blue line) have a high rate of adoption, at about 62% in 2018. In contrast, trailer aerodynamic improvements (purple line) have a much lower rate of adoption, at about 25% in 2018.

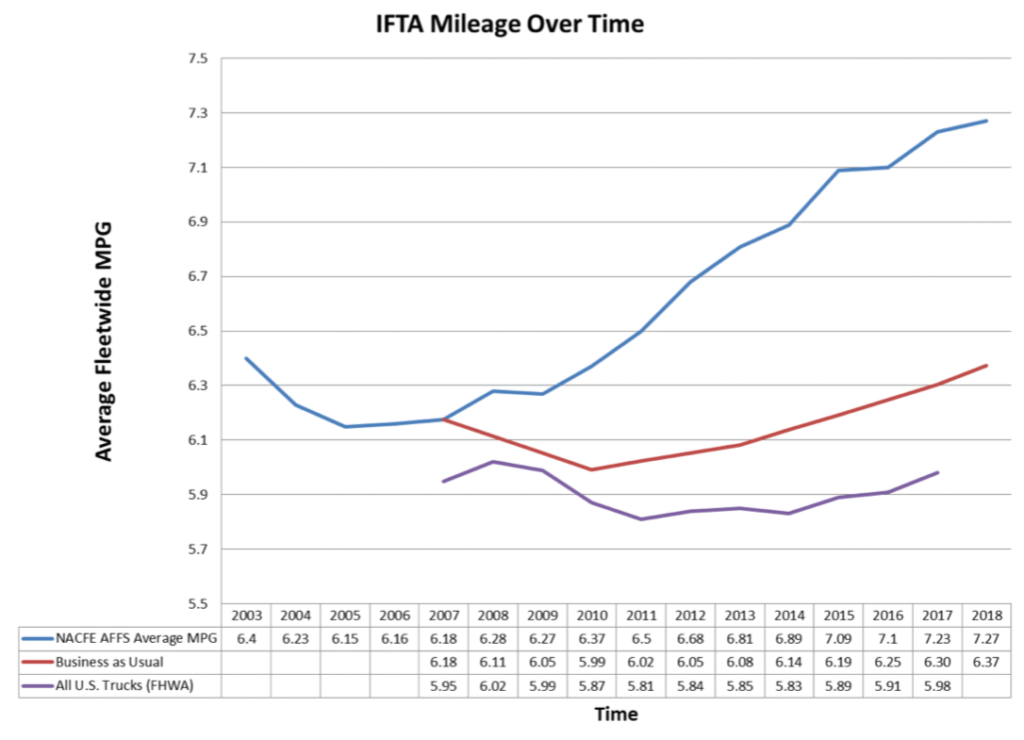

The Annual Fleet Fuel Study includes an analysis of the average fuel economy delivered by the combined Class 8 tractor-trailer fleet. Over the 16 years of this study, the average year-on-year improvement in fuel economy has been 2.0%. Fuel economy results are summarized in the following chart.

Key points in this chart are:

- The blue line represents the average fuel economy of the NACFE fleet from 2003 to 2018. In 2018, the NACFE fleet-wide average fuel economy increased to 7.27 mpg.

- The red line is a hypothetical “business as usual” case, which is an estimate of what NACFE fleet fuel economy would be based only on improvements in engine efficiency. In 2018, “business as usual” would have yielded 6.37 mpg.

- The difference between the blue and red curves represents the fuel efficiency improvements attributable to all other technologies and practices. In 2018, that difference was 0.9 mpg, meaning that actual performance was 14% better than the “business as usual” case.

- The lowest (purple) curve is based on actual data reported to the U.S. Department of Transportation’s Federal Highway Administration (FHWA) for the approximately 2.5 million over-the-road tractor-trailers operating in the US. This average fleet fuel efficiency in 2017 was 5.98 mpg, well behind the fuel efficiency performance reported by NACFE fleet operators (which is included in the FHWA data).

4. Accessories available to improve the aerodynamic efficiency of existing tractor-trailers

The typical big rig has an aerodynamic drag coefficient, CD, of over 0.6, which has a huge effect on fuel economy, particularly during high-speed highway driving. Many truck manufacturers and third-party firms offer add-on kits with a variety of devices that can be installed on an existing tractor-trailer to improve its aerodynamic efficiency. Here we’ll look at a few of those devices:

- Trailer tails (tapered boat-tails on the back of the trailer)

- Trailer skirts

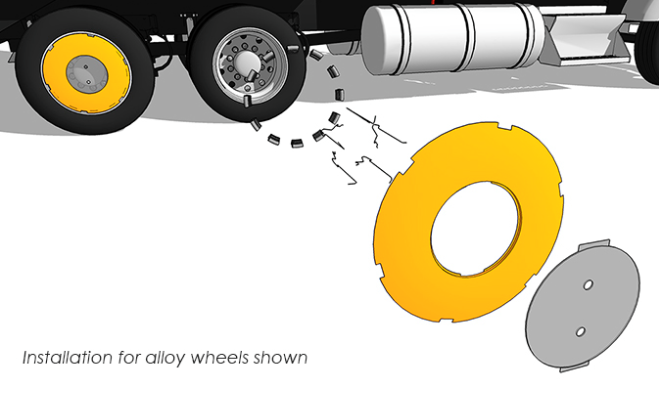

- Aerodynamic wheel covers

The U.S. firm STEMCO (http://www.stemco.com) offers two aero kits for improving conventional tractor-trailer aerodynamics:

- TrailerTail®, which is installed at the back of the trailer, reduces the magnitude of the turbulent low-pressure area that forms behind the trailer at high speeds.

- EcoSkirt®, which is installed under the trailer, reduces aerodynamic drag under the trailer where air hits the trailer’s rear axles. The side fairings streamline and guide the air around the sides and to the back of the trailer.

Both of these aerodynamic devices are shown in the following figure. This was a tractor-trailer configuration that I saw frequently on I-90.

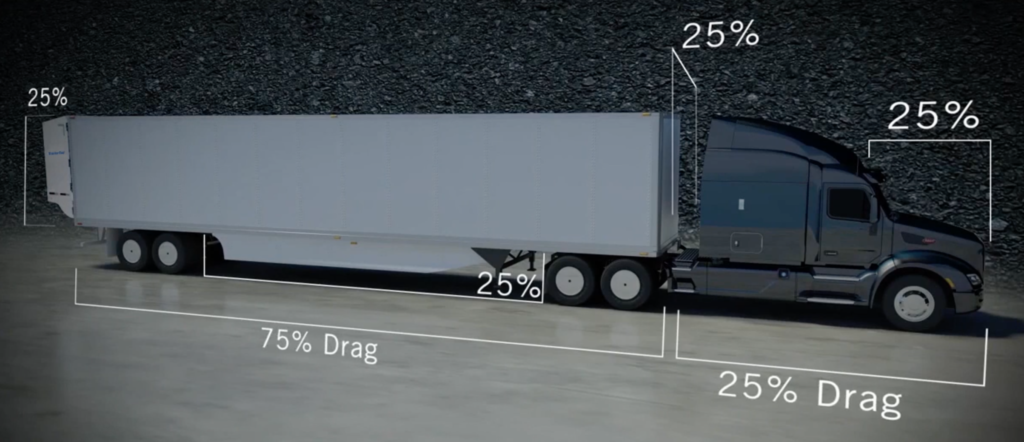

STEMCO allocates the primary sources of tractor-trailer aerodynamic drag as shown in the following figure.

STEMCO claims the following benefits from their aero kits:

- “TrailerTail® fuel savings complement other aerodynamic technologies.”

- “A TrailerTail® reduces aerodynamic drag by over 12% equating to over 5% fuel efficiency improvement at 65 mph (105 kph) and over 12% fuel efficiency improvement when combined with STEMCO’s side skirts and other minor trailer modifications.”

STEMCO TrailerTail® meets the SmartWay® advanced trailer end fairings criteria for a minimum of 5% fuel savings and the STEMCO EcoSkirt® meets the advanced trailer skirts qualifications with greater than 5% fuel savings. The payback period for these aero devices is expected to be about one year.

You’ll find more details on STEMCO’s tractor-trailer drag reduction products, including a short “Aerodynamics 101” video, at the following link: http://www.stemco.com/aero-u/

More details on TrailerTail®, including its automatic deployment and operational use, are shown in a short video at the following link: https://www.youtube.com/watch?v=qPrM3-CCth8

Another firm, Aerotech Caps, offers a range of aero kits for improving truck aerodynamics, including aerodynamic wheel covers, aerodynamic trailer skirts, tail fairings and vortex generators. You can see their product line at the following link: https://aerotechcaps.com/#aerotechcaps

Aerotech Caps claims that its aerodynamic wheel covers deliver about 2.4% increased miles per gallon when installed on rear tractor and all trailer wheels. Payback period for this aero kit is expected to be about one year.

5. Aerodynamic Class 8 production tractor-trailers and SuperTrucks from major US manufacturers

Conventional, top-of-the-line tractor-trailers on the market today have significantly improved aerodynamic and fuel efficiency performance in comparison to their predecessors. The aero gains have been achieved by integrating many of the aero features described above into the basic designs for the latest Class 8 tractor-trailers on the market. In addition, optional aero kits are available to further improve performance.

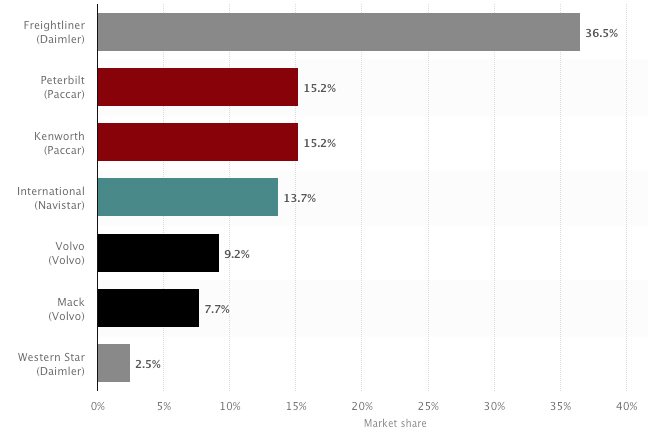

Class 8 truck manufacturers’ market share in the U.S. as of December 2019 is shown in the following chart.

Note that Freightliner is a Daimler North America brand along with Western Star. Peterbilt and Kenworth are PACCAR brands. International is a Navistar brand and Mack is a Volvo brand.

Now we’ll take a look at the most aerodynamic tractor-trailers offered in 2020 by the top five manufacturers in the US Class 8 truck market. Collectively, these manufacturers account for almost 90% of the US Class 8 heavy truck market.

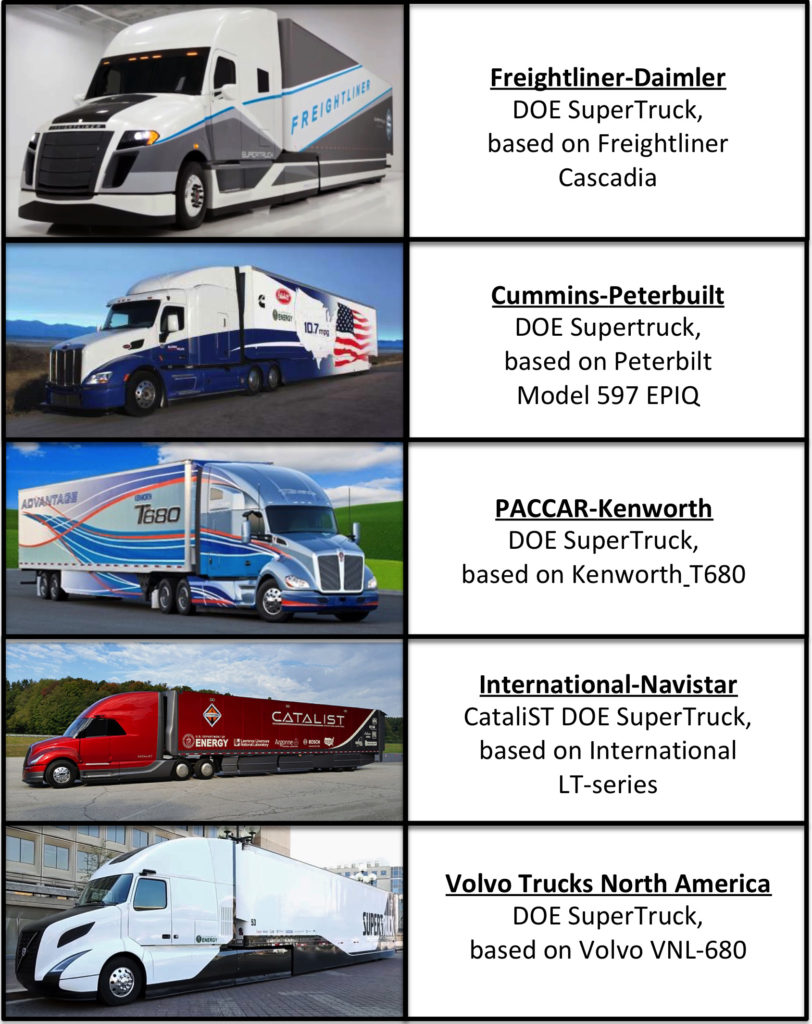

Four of the five top manufacturers, Freightliner, Peterbilt, International and Volvo, led teams in the DOE SuperTruck 1 program (2010-2016) and are continuing their participation in the SuperTruck 2 program (2017 – 2022). Kenworth did not participate in SuperTruck 1, but did participate in SuperTruck 2 as a member of a new team led by their parent firm, PACCAR.

You’ll find my articles on these tractor-trailers at the following links:

- Freightliner Cascadia and the Freightliner-Daimler DOE SuperTruck: https://lynceans.org/wp-content/uploads/2020/04/Freightliner_Daimler-converted.pdf

- Peterbilt Model 597 EPIQ and the Cummins-Peterbuilt DOE Supertruck: https://lynceans.org/wp-content/uploads/2020/04/Peterbilt_Cummins-converted.pdf

- Kenworth T680 and the PACCAR-Kenworth DOE SuperTruck: https://lynceans.org/wp-content/uploads/2020/04/Kenworth_PACCAR-converted.pdf

- International LT-series and the International-Navistar CataliST DOE SuperTruck: https://lynceans.org/wp-content/uploads/2020/04/International_Navistar-converted.pdf

- Volvo Trucks North America VNL-680 and the Volvo DOE SuperTruck: https://lynceans.org/wp-content/uploads/2020/04/Volvo-Trucks-North-America-converted.pdf

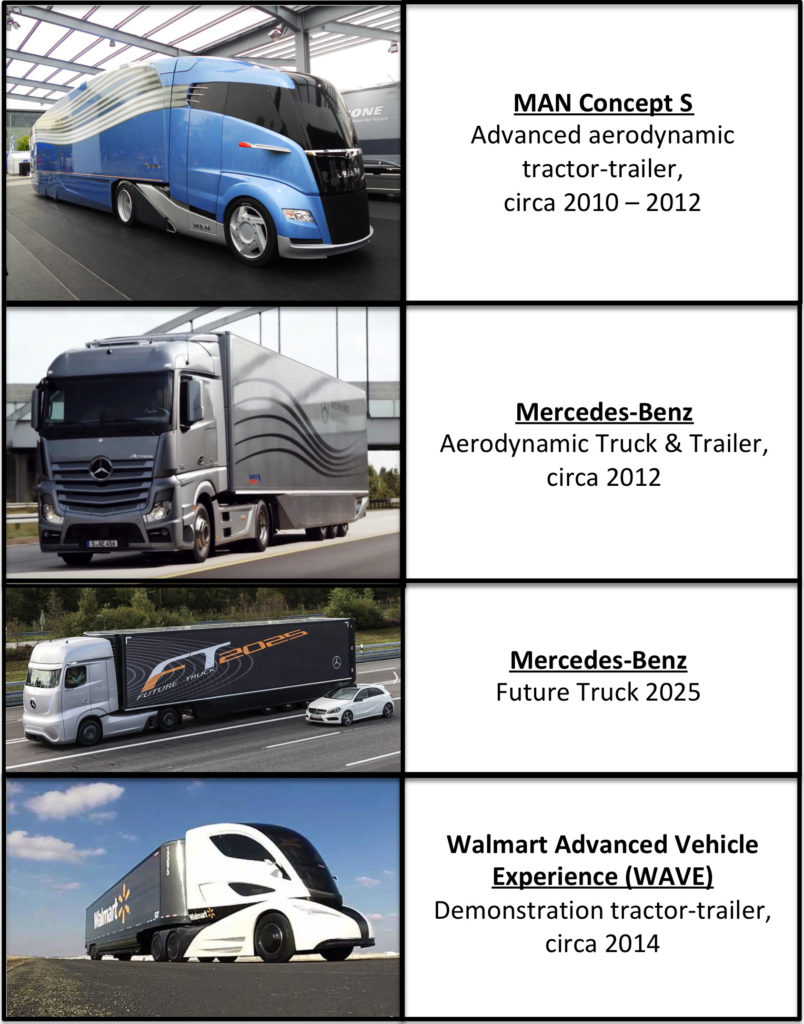

6. Other advanced Class 8 tractor-trailer designs and test trucks

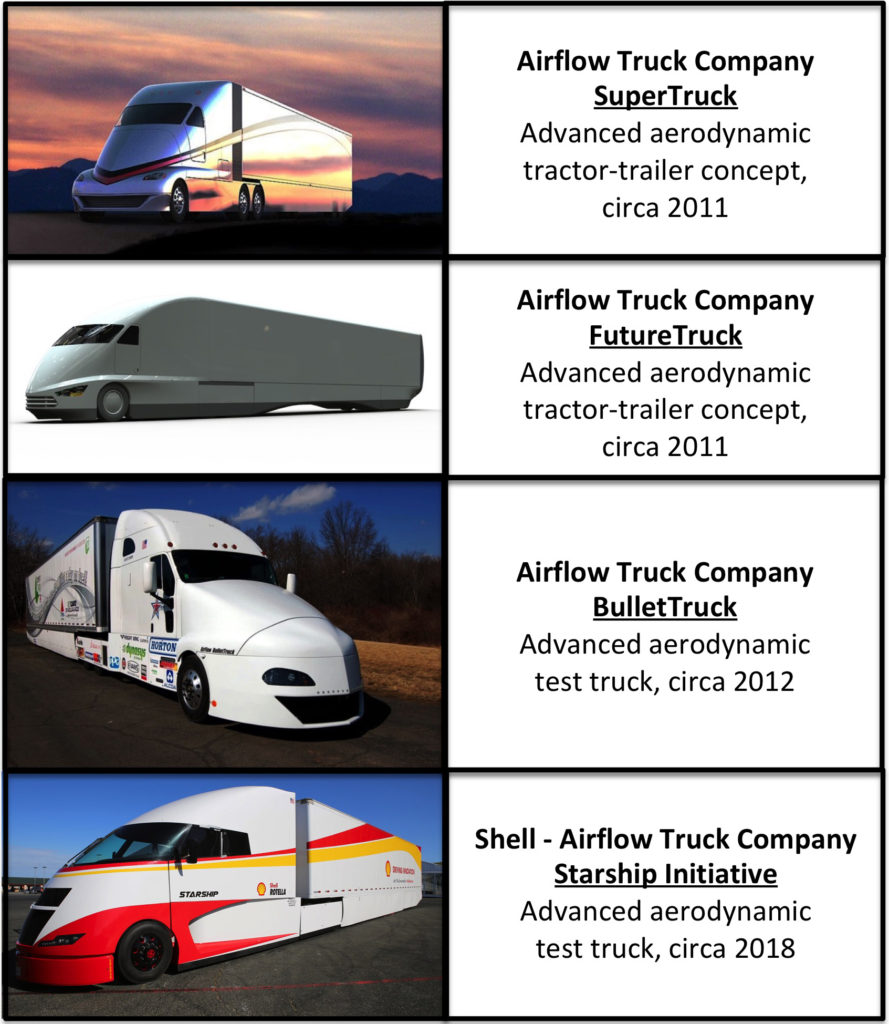

The future of heavy freight vehicles is certain to include increasingly aerodynamic tractor-trailers with more efficient diesel and hybrid powertrains. While the five teams participating in the DOE SuperTruck program are demonstrating significantly improved Class 8 tractor-trailer performance, other firms have been working in parallel to develop their own advanced truck concepts and test trucks. In this section, we’ll take a look at the following advanced integrated tractor-trailers.

You’ll find my articles at these tractor-trailers at following links:

- MAN Concept S: https://lynceans.org/wp-content/uploads/2020/04/MAN-Concept-S-tractor-trailer-converted.pdf

- Mercedes-Benz Aerodynamic Truck and Trailer 2012 and Future Truck 2025: https://lynceans.org/wp-content/uploads/2020/04/Mercedes-Benz-Aero-Truck-2012-Future-Truck-2025-converted.pdf

- Walmart Advanced Vehicle Experience (WAVE): https://lynceans.org/wp-content/uploads/2020/04/Walmart-Advanced-Vehicle-Experience-converted.pdf

- Airflow Truck Company concepts & test trucks: https://lynceans.org/wp-content/uploads/2020/04/AirFlow-Truck-Company-converted.pdf

7. Advanced electric-powered Class 8 tractor-trailers

A variety of electric-powered heavy trucks and tractor trailers are being developed for the worldwide market and several are being operationally tested. The most common electric energy sources are be battery-electric or hydrogen fuel cell + battery.

Regarding these two electric power sources, CleanTechnica reported (https://cleantechnica.com/2019/04/22/):

- “Battery electric vehicles are around 90% efficient with the electricity that flows into the charger when it is converted into motion by the onboard motors.”

- “Hydrogen fuel cell vehicles are understandably less efficient, using the source electricity to break apart water, compress it, transfer it into the vehicle, and then convert the hydrogen back into electricity by combining it with ambient oxygen. Estimates for the efficiency of the electricity used to produce hydrogen, then get converted back to electricity in fuel cell vehicles, is around 40%.”

Lithium-ion batteries currently are the dominant type of battery used in electric vehicles. Boston Consulting Group reported that one particular type, the lithium nickel-manganese-cobalt (NMC) battery, has good overall performance, excels on specific energy, has the lowest self-heating rate, and is a preferred candidate for electric vehicles. For more information, see the 10 July 2019 Battery University article, “BU-205: Types of Lithium-ion Batteries,” at the following link: https://batteryuniversity.com/learn/article/types_of_lithium_ion

While less efficient in overall energy conversion, the hydrogen fuel cell weighs much less and can store much more energy than a comparably-sized, current-generation battery packaged for a heavy-duty truck application. For more information on hydrogen fuel cells, see the May 2017 University of California (UC) Davis presentation, “Fuel Cells and Hydrogen in Long-Haul Trucks,” at the following link: https://steps.ucdavis.edu/wp-content/uploads/2017/05/Andy-Burke-Hydrogen-Fuel-Cell-Trucks.pdf

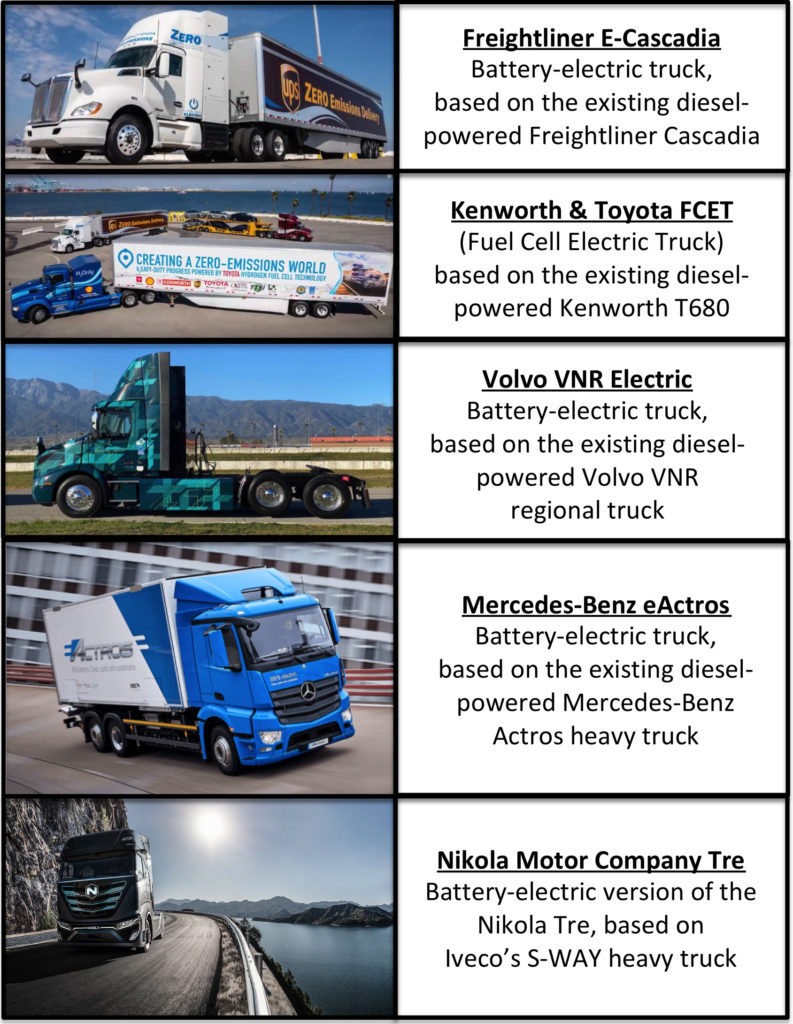

In 2020, several heavy-duty electric truck designs are adaptations of existing Class 8 tractor-trailers with all-new electric powertrains. Examples are shown in the following table.

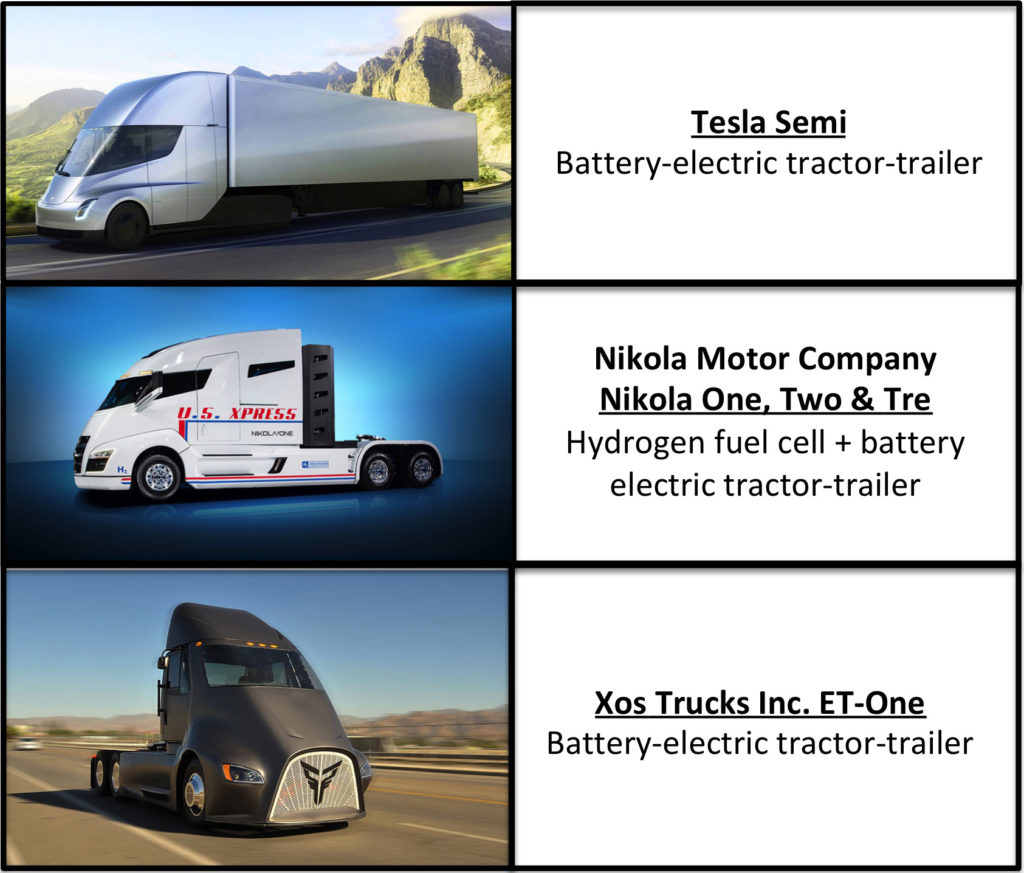

Some designs in 2020 were “clean-sheet” advanced electric-powered Class 8 tractor-trailers that also may offer a future path toward autonomous vehicle operation. Examples include:

Then there are even more advanced electric-powered heavy trucks that are designed originally as autonomous freight haulers without provisions for a driver’s cab. For example:

You can get a good overview of the current state of electric-powered heavy truck development in the following October 2019 video by Automotive Territory: “10 All-Electric Trucks and Freighters Showcasing the Future of Cargo Vehicles” (11:17 minutes): https://www.youtube.com/watch?v=smAleMBEszs

In this section, we’ll take a look at the “clean-sheet” advanced electric-powered Class 8 tractor-trailers. You’ll find my articles at these tractor-trailers at following links:

- Tesla Semi: https://lynceans.org/wp-content/uploads/2020/04/Tesla-Semi-converted.pdf

- Nikola One, Nikola Two & Nikola Tre: https://lynceans.org/wp-content/uploads/2020/04/Nikola-Motor-Co-converted.pdf

- Xos Trucks ET-One: https://lynceans.org/wp-content/uploads/2020/04/Xos_Thor-Trucks-converted.pdf

The DOE-sponsored SuperTruck 3 program initiated in 2022, which is funding work to develop battery-electric and fuel cell medium- and heavy-duty trucks and freight system solutions, is not funding any of the above three companies.

8. Conclusions:

Freight currently accounts for 9% of all U.S. greenhouse gas (GHG) emissions, and trucking is the dominant mode. The gradual phase-in of tractor-trailers with refined aerodynamics and diesel engines is improving fleet-wide fuel economy and thereby helping to decrease the carbon footprint of long-haul trucking.

Large improvements in freight efficiency (the product of payload weight in tons and fuel economy in miles per gallon; ton-miles per gallon) were demonstrated during the DOE SuperTruck 1 program, and greater gains are expected in SuperTruck 2, which continued into 2023. In the meantime, truck manufacturers are implementing SuperTruck technologies in their production model tractor-trailers. This is a significant step in the right direction.

With the introduction of electric-powered tractor-trailers in the next decade, the trucking industry has an opportunity to revolutionize its operations by deploying fleets of zero-emission trucks. The very aerodynamic, electric-powered Tesla Semi and the smaller freight vehicles being developed by Xos seem to be good first steps in starting the electric freight revolution. They will be joined by other electric-powered tractor-trailers and smaller freight vehicles being developed under the DOE SuperTruck 3 program, which will run thru 2027.

For the electric-powered trucks to compete effectively with diesel and hybrid-powered truck, the truck manufacturers and the freight industry needs to support deployment of the diverse nation-wide infrastructures for very-high capacity battery recharging and hydrogen refueling. With these new infrastructures in place, electric-powered freight operations can become routine and make a big contribution to reducing GHG emissions and the environmental impact of the nation’s freight hauling industry.

In spite of all of these opportunities for improving heavy tractor-trailer performance, there always will be cases when few of these are actually practical. As evidence, I offer the following photo taken at 80 mph on I-90 in South Dakota during my 2016 road trip. How do you optimize that giant drag coefficient?

9. For additional information:

General tractor-trailer aerodynamics

- Webster Jorgensen, “How Better Aerodynamics Lead to Fuel Savings,” RTSFinancial, 19 January 2019: https://www.rtsinc.com/guides/how-better-aerodynamics-lead-fuel-savings

- Mir Atiqullah and Emmanuel Nnamani, “Aerodynamic Drag Reduction of Class 8 Trailer Trucks Using External Attachments,” June 2017: https://docs.lib.purdue.edu/cgi/viewcontent.cgi?article=1028&context=polytechsummit

- John WoodRooffe, “Reducing Truck Fuel Use and Emissions: Tires, Aerodynamics, Engine Efficiency and size and weight Regulations,” Report UMTRI-2014-27, University of Michigan, Transportation Research Institute, November 2014: https://pdfs.semanticscholar.org/0ede/36ee4669620d0b395fe92c8dc037fc5af6d0.pdf?_ga=2.148471924.2125104468.1585080201-1393104622.1585080201

- “Technologies and Approaches to Reducing the Fuel Consumption of Medium- and Heavy-Duty Vehicles,” National Academies Press, 2010: https://www.nap.edu/catalog/12845/technologies-and-approaches-to-reducing-the-fuel-consumption-of-medium-and-heavy-duty-vehicles

DOE SuperTruck 1 Program

- White paper: O. Delgado & N. Lutsey, “The U.S. SuperTruck Program – Expediting the Development of Advanced Heavy-Duty Vehicle Efficiency Technologies,” The International Council on Clean Transportation, June 2014: https://theicct.org/sites/default/files/publications/ICCT_SuperTruck-program_20140610.pdf

- DOE Presentation: “SuperTruck – An Opportunity to Reduce GHG Emissions while Meeting Freight Hauling Demands,” 22 April 2015: https://ww3.arb.ca.gov/msprog/onroad/caphase2ghg/presentations/1_4_roland_g_usdoe.pdf

- National Academies report: “Review of the 21st Century Truck Partnership: Third Report,”, particularly Chapter 8, “SuperTruck,” 2015; https://www.nap.edu/download/21784

- Presentation: Alicia Birky, “US DOE SuperTruck Initiative,” Energetics, Inc., December 2015: https://steps.ucdavis.edu/files/12-03-2015-Birky-UCDavis-SuperTruck-2015-12-03.pdf

- DOE fact sheet: “SuperTruck Success – Progress on Fuel Efficiency and Market Adoption,” DOE/EE-1419, June 2016: https://www.energy.gov/sites/prod/files/2016/06/f33/EERE_SuperTruck_FS_R121%20FINAL.pdf

- DOE Report to Congress: “Adoption of New Fuel Efficient Technologies From SuperTruck,” Department of Energy, June 2016: https://www.energy.gov/sites/prod/files/2016/06/f32/Adoption%20of%20New%20Fuel%20Efficient%20Technologies%20from%20SuperTruck%20-%206-22-16%20%28002%29.pdf

DOE SuperTruck 2 Program (2017 to 2022)

- “Energy Department Announces $137 Million Investment in Commercial and Passenger Vehicle Efficiency,” Department of Energy,16 August 2016: https://www.energy.gov/articles/energy-department-announces-137-million-investment-commercial-and-passenger-vehicle

- “PACCAR joins DOE SuperTruck II initiative; 5 teams now in program,” Green Car Congress, 30 August 2017: https://www.greencarcongress.com/2017/08/20170830-paccar.html

- Sara Jensen, “SuperTruck II Merit Reviews,” (includes links to the 2019 Annual Merit Review presentations), OEM Off-Highway, 3 July 2019: https://www.oemoffhighway.com/market-analysis/industry-news/on-highway/article/21076097/supertruck-ii-merit-reviews

- DOE press release: “SuperTruck 2 – PACCAR,” DOE Vehicle Technologies Office, 11 June 2021: https://www.energy.gov/eere/vehicles/articles/supertruck-2-paccar

- “Is SuperTruck Worth the Money?,” TruckingInfo, 24 January 2022: https://www.truckinginfo.com/10160190/is-supertruck-worth-the-money

- Darek Villeneuve, “Improving Transportation Efficiency Through Integrated Vehicle, Engine and Powertrain Research – SuperTruck 2,” Daimler Trucks North America, Project ACE100, 2022 Annual Merit Review presentation to DOE, 24 June 2021: https://www.energy.gov/sites/default/files/2021-06/ace100_villeneuve_2021_o_5-14_606pm_KF_TM.pdf

- Eric Bond, “Volvo SuperTruck 2 – Pathway to Cost-Effective Commercialized Freight Efficiency,” Volvo, Project ACE101, 2022 Annual Merit Review presentation to DOE, 23 June 2022: https://www1.eere.energy.gov/vehiclesandfuels/downloads/2022_AMR/ace101_bond_2022_o_5-1_129pm_ML.pdf

- Jon Dickson, “Cummins / Peterbuilt SuperTruck II,” Cummins Peterbuilt, Project ACE102, 2022 Annual Merit Review presentation to DOE, 23 June 2022: https://www1.eere.energy.gov/vehiclesandfuels/downloads/2022_AMR/ace102_dickson_2022_o_rev2%20-%20TrailLife-GCCC%20IN0110%20REVISED.pdf

- Russ Zukouski, “Navistar SuperTruck II – Development and Demonstration of a Fuel-Efficient Class 8 Tractor and Trailer,” Navistar, Project ACE103, 2022 Annual Merit Review presentation to DOE, 21 – 23 June 2022: https://www1.eere.energy.gov/vehiclesandfuels/downloads/2022_AMR/ace103_%20Zukouski_2022_o_4-29_1232pm_ML.pdf

- Maarten Meijer, “Development and Demonstration of Advanced Engine and Vehicle Technologies for Class 8 Heavy-Duty Vehicle (SuperTruck II), PACCAR, Project ACE124, 2022 Annual Merit Review presentation to DOE, 23 June 2022: https://www1.eere.energy.gov/vehiclesandfuels/downloads/2022_AMR/ace124_Meijer_2022_o_4-29_1056pm_KF.pdf

- Alan Adler, “Freightliner SuperTruck II looks for technology life after research,” FreightWaves, 2 February 2023: https://www.freightwaves.com/news/freightliner-supertruck-ii-looks-for-technology-life-after-research

- Maarten Meijer, “Development and Demonstration of Advanced Engine and Vehicle Technologies for Class 8 Heavy-Duty Vehicle (SuperTruck II), PACCAR, Project ACE124, 2023 Annual Merit Review presentation to DOE, 15 June 2023: https://www1.eere.energy.gov/vehiclesandfuels/downloads/2023_AMR/DORMA036_Meijer_2023_o_rev5%20-%20Ryan%20Monahan.pdf

- “Navistar Reveals International® SuperTruck II Results with Improved Fuel and Freight Efficiency, Goals for Hybridization,” Navistar press release, 20 June 2023: https://news.navistar.com/2023-06-20-Navistar-Reveals-International-R-SuperTruck-II-Results-with-Improved-Fuel-and-Freight-Efficiency,-Goals-for-Hybridization

- “NETL Project Partner Daimler Truck North America Debuts Next Level of Freight Efficiency with the Freightliner SuperTruck II,” National Energy Technology Laboratory press release, 3 August 2023: https://netl.doe.gov/node/12767

- “Volvo Trucks’ SuperTruck 2 Exceeds Freight Efficiency Goals with Focus on Aerodynamics and Advanced Engineering,” Volvo press release, 10 October 2023: https://www.volvotrucks.us/news-and-stories/press-releases/2023/october/volvo-trucks-supertruck-exceeds-freight-efficiency-goals-with-focus-on-aerodynamics-and-advanced-engineering/

- Jonathan Gitlin, “A 50 percent more efficient big rig? Meet Super Truck II, ARS Technica, 27 October 2023: https://arstechnica.com/cars/2023/10/a-50-percent-more-efficient-big-rig-meet-super-truck-ii/

- Deborah Lockridge, “A Closer Look at Volvo’s Super-Efficient SuperTruck 2,” TruckingInfo, 21 November 2023: https://www.truckinginfo.com/10210797/a-closer-look-at-volvos-super-efficient-supertruck-2

- Jason Morgan, “Peterbilt SuperTruck 2 takes center stage at CES,” Fleet Equipment, 18 January 2024: https://www.fleetequipmentmag.com/unscripted-peterbilt-supertruck-ces/

- “SuperTruck 2: Empowering Future Trucking,” North American Council for Freight Efficiency (NACFE), 4 March 2024: https://nacfe.org/research/thought-leadership/supertruck-2-empowering-future-trucking/

DOE SuperTruck 3 Program (2022 to 2027)

- “DOE announces $162 Mission to Decarbonize Cars and Trucks,” Department of Energy, 15 April 2021: https://www.energy.gov/articles/doe-announces-162-million-decarbonize-cars-and-trucks

- “SuperTruck 3 By DOE,” esg Review, 21 April 2021: https://esgreview.net/2021/04/21/supertruck-3-by-doe/

- “U.S. DOE Announces More than $127 Million for SuperTruck 3,” ACTnews, 3 November 2021: https://www.act-news.com/news/u-s-doe-announces-more-than-127-million-for-supertruck-3/

- Alan Adler, “Paccar, Daimler, Volvo get bulk of $127M in SuperTruck 3 funding,” FreightWaves, 2 November 2021: https://www.freightwaves.com/news/paccar-daimler-volvo-get-bulk-of-127m-in-supertruck-3-funding

- “Daimler Working with Oregon State on SuperTruck 3 FCEV Project, TruckingInfo, 17 January 2023: https://www.truckinginfo.com/10190506/daimler-working-with-oregon-state-on-supertruck-3-fcev-project

- Maarten Meijer, “Development and Demonstration of Zero Emission Technologies for Commercial Fleets (SuperTruck 3), PACCAR, Project ELT285, 2023 Annual Merit Review presentation to DOE, 15 June 2023: https://www1.eere.energy.gov/vehiclesandfuels/downloads/2023_AMR/ELT285_Meijer_2023_o%20v3%20-%20Ryan%20Monahan.pdf

- Eric Bond, “Volvo SuperTruck 3 – A Zero Emission Freight Future,” Volvo, Project ELT286, 2023 Annual Merit Review presentation to DOE, 13 June 2023: https://www1.eere.energy.gov/vehiclesandfuels/downloads/2023_AMR/ELT286_Bond_2023_o%20-%20Eric%20Bond.pdf

- “Conference report: US DOE Vehicle Technologies Annual Merit Review 2023,” DieselNet, 5 July 2023: https://dieselnet.com/news/2023/07amr.php